CryptoSlate Wrapped Daily: Voyager defends Binance.US's offer; Nomad exploiter moves stolen funds

Voyager defends Binance.US' bid for its assets, while funds related to last year's nomad attack were moved to Tornado Cash. Read these stories and more in today's edition of CryptoSlate Wrapped.

|

| crypto news |

The biggest news in the crypto world for January 9 is that Voyager has responded again to objections to Binance.US' attempt to acquire its digital assets. Meanwhile, the Forbes report drew attention to Binance's large outflows, and $1.57 million of funds associated with Nomad's 2022 exploit shifted to Tornado Cash. In addition, new research on two types of bitcoin investors: "shrimp" and "crab".

CryptoSlate Top Stories

The bankrupt cryptographic creditor voyager described Alameda's objection to the Binance.US offer for his assets as "hypocrisy and chutzpah."

Voyager said the bankrupt crypto exchange desperately tried to undermine and sabotage restructuring efforts. The lender said Alameda tried to front-run his marketing proposal by offering a lowball proposal that discredits his businesses.

Voyager added that Alameda's objection to the level of disclosure of certain interrelated allegations was "unfounded" because FTX's attorney reviewed and endorsed those allegations two months ago. In addition, the same applications were approved by an appropriate court.

Binance has seen a significant outflow of assets over the past two months, according to a recent Forbes report.

Forbes analysts penetrated deep into Binance's wallets and found that the stock market had seen outflows of about $12 billion since November. Aside from the massive outflows, the report finds that the discrepancy between the reports on Binance holdings is worrying.

A wallet address linked to the nomad's $190 million holding moved about $1.57 million to Tornado Cash, sanctioned by OFAC.

On August 1, 2022, a hacker exploited the Nomad Bridge to withdraw about $100 WBTC worth $2.3 million. The malicious code used for exploitation was exposed, which resulted in several copycat hacks – resulting in a total of $190.7 million being drained from the protocol.

It turns out that several white hat hackers have returned about $22 million to Nomad, which is about 4.8% of the stolen funds.

Hong Kong's financial secretary, Paul Chan, said the government has finalized its cryptocurrency regulatory framework, which will take effect in June 2023.

Speaking at the POW'ER Web3 Summit on January 9, Chan said that the legislative framework needed to issue licenses to virtual asset providers has been completed.

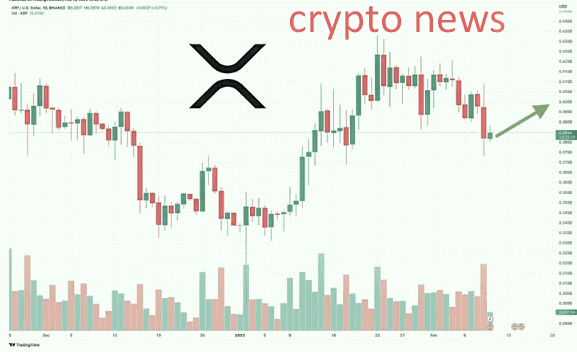

Bitcoin's short liquidations continue to pile up as BTC moves higher.

Coinglass revealed that $53.24 million in shorts had been liquidated since the beginning of the year. In contrast, $11.98 million in longs were liquidated during the same period.

The four-hour chart showed the divergence between shorts and longs that takes effect predominantly on January 8 – 9, as Bitcoin was rejected at $17,000, only to take a decisive break from this level a few hours later.

The total value of blocked assets (TVL) in Cardano's Defi ecosystem has risen 20% in the last 24 hours to $65.91 million, according to Defillama data.

Cardano's Defi TVL fell below $60 million on November 10, 2022, ending the year below the threshold. However, the ecosystem has gradually recovered since the beginning of the new year, after a growth of 35.66% in the last seven days.

The U.S. government has officially seized the Robinhood shares of FTX founder Sam Bankman-Fried (SBF), which equates to $455 million, as Reported by WatcherGuru.

The South Korean Huobi subsidiary, Huobi Korea, is set to function as an individual entity after cutting its ties with Huobi Global, according to a report by Korean news agency News1.

Focus on research

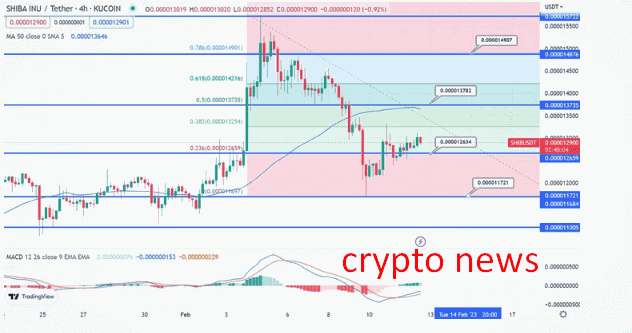

Glassnode data analyzed by CryptoSlate showed a significant trend difference between the “Bitcoin” (BTC) and “Ethereum” (ETH) shrimp and crab cohorts.

The basic narrative of BTC fundamentals is why so many investors believe in the asset – and buy regardless of price. Evidence of this can be seen below that Shrimp (owning a BTC or less) buy BTC more aggressively than ever before, according to Glassnode's on-the-data chain.

At press time, BTC shrimps hold a total of 1,200,000 BTC and have bought about 90,000 BTC in the last 30 days. Evidence of this trend has been seen as BTC shrimps have accumulated 60,000 BTC over the course of 30 days in December 2022.

However, compared to ETH shrimps (which hold an ETH or less), the trend is reversed – witnessing a sale of 300,000 ETH over a 30-day period. The mindset of ETH shrimp is very different from that of BTC holders. as shrimps become net sellers – holding about 1,600,000 ETH at press time.

Crypto market

Over the past 24 hours, Bitcoin (BTC) has risen 1.35% to $17,186.10, while Ethereum (ETH) has risen 3.86% to $1,318.95.

Largest gainers (24h)

FTX Token (FTT): 56.9%

Aptos (APT): 33.31%

Nervous network (CKB): 24.92%

The biggest losers (24h)

Lido DAO Token (LDO): -5.51%

ssv.network(SSV): -5.18%

Ocean protocol (OCEAN): -4.98%

Posted In: Wrapped

Connect your digital wallet, and trade with Orion Swap Widget.

Directly from this Widget: Top CEXs + Aggregate DEXs through Orion. No account, global access.