Bitcoin, Ethereum technical analysis: BTC at a 2-year low, ETH down 20% as FTX turmoil leads to a crypto bloodbath

Bitcoin, Ethereum technical analysis: BTC at a 2-year low, ETH down 20% as FTX turmoil leads to a crypto bloodbath

Bitcoin plunged to its lowest level in two years on Wednesday as the sale of FTX tokens continued to weigh on cryptocurrency markets. After an initial drop of 30%, the FTX token fell 80% as Binance confirmed its intention to absorb the failing exchange. Ethereum was also lower, dropping below $1,200.

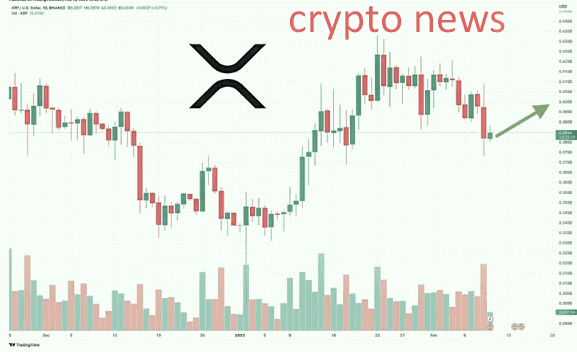

Bitcoin

Bitcoin fell to its lowest level in two years on Wednesday as markets continued to react to the volatility caused by the FTX/Binance affair.

The world's largest cryptocurrency plunged to a low of $17,402.55 earlier in today's session, less than a day after hitting a high of $20,582.24.

The move, which saw prices fall by as much as 10%, took BTC/USD to its lowest level since November 2020.

the decline intensified as the token fell below its long-term support level of $19,000.

On top of that, the 14-day Relative Strength Index (RSI) has also slipped to its own low, which is near the 29.75 level.

BTC has rebounded somewhat from previous lows, with the token now trading at $17,718.95, with some bulls hoping for support around $17,900 to be established.

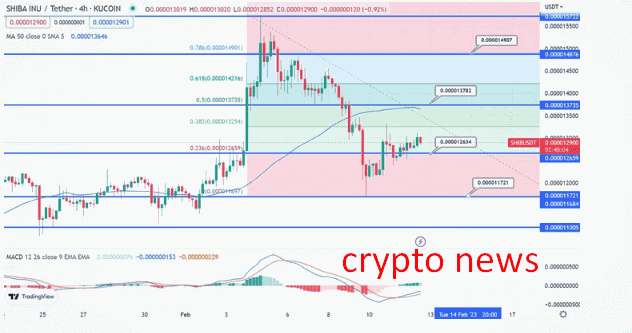

Ethereum

In addition to BTC, Ethereum (ETH) also fell significantly during today's session, with prices falling below $1,200 in the process.

After hitting a high of $1,564.55 on Tuesday, ETH/USD fell 20%, hitting a low of $1,157.23.

This decline saw ETH hit its lowest level since July 14, when the token traded slightly above $1,000.

As with bitcoin above, the RSI on this Ethereum chart is now trailing at 33.00, which is slightly above a low of 32.50.

This reading, which is the lowest reading in the past five months, means prices are now in oversold territory, which long-term bulls believe means a bottom has been reached.

However, the 10-day moving average (red) continues to decline, and if this trend continues, it is likely that ETH will break below $1,000.