How To Evaluate Any Crypto Project With Fundamental Analysis

Different from traditional markets, the crypto market has its own set of key questions to consider when considering a project and its assets.

Market Analysis

Fundamental analysis is the process of finding the intrinsic value of an asset in order to determine whether the asset is overvalued or undervalued. This information can then be harnessed together with technical analysis to decide whether to invest or trade an asset.

In the fundamental analysis of cryptocurrencies, the approach is somewhat different from that commonly used to evaluate legacy market assets. Crypto assets do not have the necessary historical data, as there is usually no history of earnings reports or profit and loss statements.

Analyzing a cryptocurrency requires gathering all available information about an asset through research, including examining its use case, network, team behind the project, investment plans, etc. By analyzing the correct factors, traders can determine the fundamental value of the underlying item before investing.

Here are 10 steps you'll find most helpful:)

Examining the white paper of a project reveals the use case that the crypto asset is targeting and the problem it is trying to solve. Then we should think about whether or not this use case is, in fact, viable and desired.

* Read the white paper

Especially for long-term buy-and-hold investments, reading the token's white paper is essential. This is the document that provides a detailed overview of what to expect from the project. A good white paper explains:

- Project objectives

- Use and distribution cases

- Team vision

- The technology behind the token

- Upgrade plans and new features

- How does it provide token value to users

* Evaluate the claims from the white paper

Be skeptical because the people behind the project can distort and even destroy the truth.

This happens more often than most people realize. For example, Michael Alan Stolary, CEO and founder of Titanium Blockchain Infrastructure Services, raised $21 million in an ICO He later admitted that he had falsified parts of the project's white paper.

Before committing any money to a project, it's important to ask some tough questions and get complete answers.

A few questions to think about:

- Are tokens really distributed as they promise?

- Do they meet the expectations of the roadmap?

- Are they just making up a problem to solve it? What do other people say about it?

- Are there any red flags?

- Do the goals seem realistic?

* Look at competitors

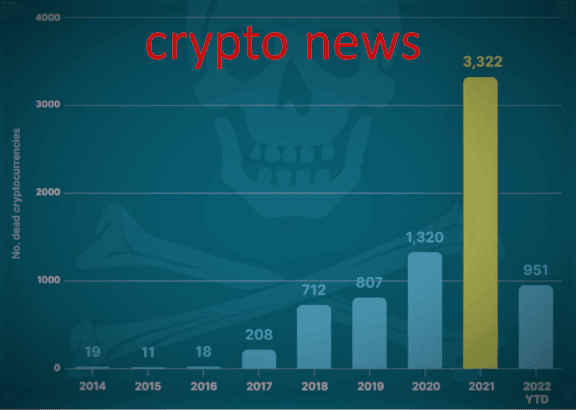

According to industry sources, almost 40% of cryptocurrencies listed in 2021 no longer exist.

This serves as an important fact that investors should take into account; a lot of projects – almost half and can be more – fail

|

| Graph of cryptocurrencies disabled on Coin Gecko, by year listed. Source: Coin Gecko |

Also, it is important to identify competing projects and review existing projects, which, if successful, could be replaced by this new project. In the end: smart investors need to know if this project is more feasible than others.

You have to know who is the team behind the project

A project is only good if the team behind it is good.

The people offering the project must have exactly the right skills to make their project work. The white paper should have information about each team member, but conducting independent research can be helpful.

A few questions to consider about the people behind any project:

What if there is no team? Then look at the community of developers.

Find out if your project has a public GitHub. Check the number of contributors and levels of activity and interaction. The more consistent the development activity on a project, the better.

* See metrics on the series

Values in the chain are available by analyzing the data in the blockchain.

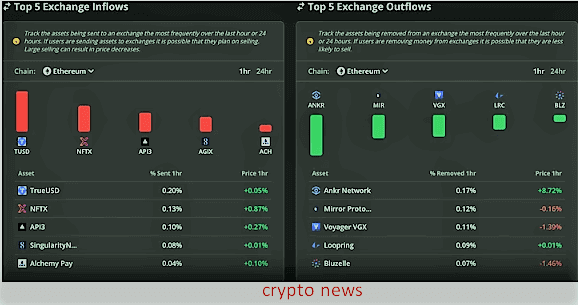

|

| Exchange input and output values. Source: Coin telegraph Markets Pro |

Data can be extracted from websites or APIs – such as chain analysis, data charts and project reports – specifically designed to inform investment decisions.

Some of the data that is worth considering:

- The number of transactions – a measure of the activity that takes place in a network. The more activity, the better.

- The value of the transaction - that is, the amount of value that was traded over a period of time. The higher this number, the better.

- Interactive Addresses - The number of addresses in the blockchain that are active at any time. Again, the more active the addresses, the better.

- Fees paid – how the demand for block space is increasing or decreasing for a token based on fees.

- Hash Rate - A metric for measuring network health in cryptocurrencies and also for proof of work. The higher the hash rate, the more difficult it is to launch an attack with a success rate of 51%

- Staking - the amount staked at a time shows the level of interest or the lack thereof in the project.

* Look at tokens

Invest in projects that create useful tokens otherwise the token may not have utility in the market.

In addition, if the symbol is useful, it is still necessary to determine how the market will embrace it, thus making sense of the price movements of the token and allowing investors opportunities for profit on a continuous basis.

Some questions to keep in mind:

- Is the token useful?

- How do people get the token?

- What is the rate of inflation or deflation?

- Was it an ICO asset?

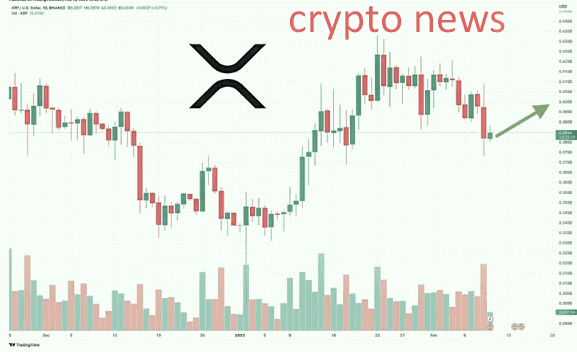

* Market capitalization, trading volume, liquidity

Some of the most important analyses relate to the financial values of the token associated with a project, including:

- Market Cap - The value of the network in terms of the hypothetical cost of purchasing each unit of the asset. Market Cap has an insight into the possibilities of network evolution and the calculation is done as follows by multiplying the traded bid by the current price.

- Transaction volume - transaction volume for a given time period (daily, weekly, monthly). This indicates whether the digital token has enough budget.

- Liquidity - A measure of how easy it is to buy and sell digital tokens. The more liquid a token is, the easier it is to sell it at the current trading price

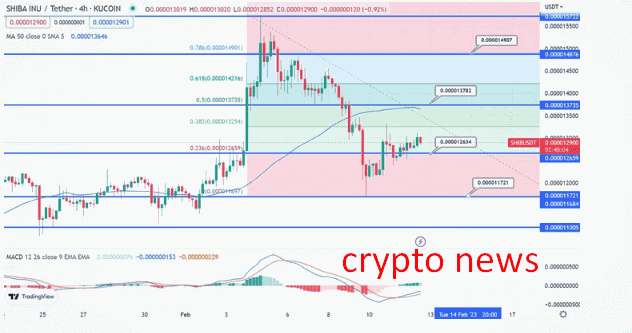

* society

When a community is behind a project, it tends to help the project token to appreciate its value.

Social media platforms, for example, can have a significant impact on the price action of a crypto asset. Meme coins, such as Dogecoin and Shiba Inu, have skyrocketed in price, in part, due to social media enthusiasm.

Recently, Solana's BONK token received a huge price increase as social media activity pushed interest rates on the asset to new highs.

|

| News Quakes™ for BONK as the social media emotion ramped up. Source: Coin telegraph Markets Pro |

A community that supports a particular currency is a powerful incentive, so here are some questions to consider:

- Is the community active and enthusiastic?

- Are there a lot of shilling accounts?

- Are the feelings strong enough?

- Are there too many developers?

Remember, the price of a token only increases if there is interest and market action. The more people talk about and invest in a token, the more likely it is that its price will appreciate.

* marketing

Investors currently have around 21,910 cryptocurrencies to choose from - the competition is fierce!

The team behind a project must actively market its token to differentiate itself from the crowd, and those in the industry say that now it is harder than ever to stand out.

In addition, with the continuous advent of new tokens on the market, established cryptocurrencies are struggling to maintain their market share.

So, the team behind the project needs to actively build brand awareness, get customers, and retain customers to improve sales and profits.

Here are some questions to consider before investing in a project:

- Is the core product marketing team well?

- Do they have a dedicated marketing team?

- Do they increase market share or not?

* If the basic product is available, test it

This might be a bit hard for someone who is just looking to invest in the underlying symbol of a project. However, let's say that an investment in Ethereum (ETH) is being considered.

Since Ethereum is a decentralized global software platform, a functional and secure digital network technology would demonstrate with certainty how the platform actually works.

Knowing this can definitely help with potential investment decisions.

After all, if the platform is hard to use, time-consuming, or otherwise creates more problems than it solves, it may be wise to clearly orient yourself from investing in such a platform until these issues are addressed.

These are ten steps that speak volumes about fundamental and robust analysis to assess an asset's upward potential before investing or trading.