Privacy currencies suffer a major setback this year with a loss of more than $6 billion, anonymity takes a back seat for "Defi" , "NFTs"

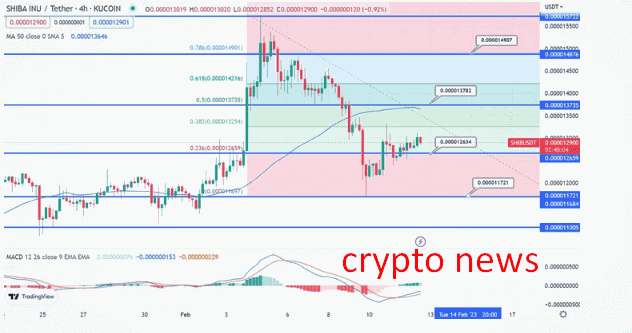

The last 12 months have been tough for digital currency investors as the winter of cryptocurrencies has caused a large amount of value to leave the once-hectic economy. The privacy currency economy, for example, has declined by more than 55% against the US dollar, as it has fallen from $11.7 billion in January 2022 to $5.22 billion today.

Privacy economy loses 55% against Greenback, European Union seems to ban anonymization of cryptocurrencies

Privacy coins are not talked about as they were before. These days, the hype and discussions surrounding decentralized finance (defiance) and non-fungible tokens (NFTs) have eclipsed currency privacy conversations.

In addition, over the past 12 months, the privacy currency economy has declined from $11.7 billion to $5.22 billion today. In January last year, the first two privacy tokens included monero (XMR) and zcash (ZEC).

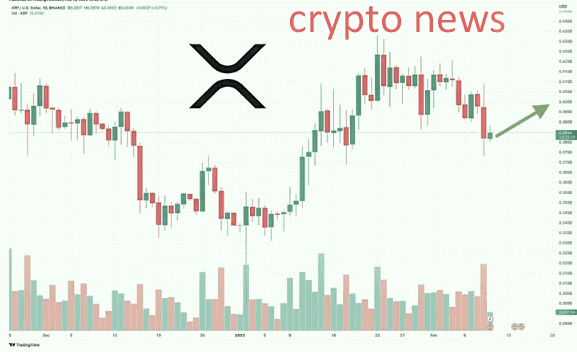

At that time, monero was the largest privacy currency by market capitalization and is still today. In January 2022, the price of XMR was about $202.97 per unit and had a market valuation of about $3.66 billion on January 19, 2022.

Today, XMR changes hands for about $142.35 per currency and has a total market capitalization of about $2.58 billion. Zcash holds the second-largest valuation of the privacy currency market this year, and in January it was about $1.53 billion.

At the end of December 2022, ZEC's market cap dropped to $517 million. The top five privacy coins since January 2022 after market capitalization have included monero (XMR), zcash (ZEC), secret (SCRT), decred (DCR) and horizen (ZEN).

|

| crypto news |

Statistics from December 2022 show that the top five privacy coins include monero (XMR) zcash (ZEC) dash (DASH) decred (DCR) and Belden (BDX). The market caps of XMR and ZEC equate to about $3.1 billion which is 59.4% of the entire privacy currency economy.

In January 2022 XMR and ZEC were valued at $5.19 billion and accounted for only 44.36% of the entire privacy currency economy Today the first two privacy currencies after the market cap has a much higher dominant position.

Last month it was reported that leaked EU plans could ban privacy coins such as XMR ZEC and DASH "The European Union could ban cryptocurrency banks and suppliers from trading currencies that increase privacy, such as zcash, monero and dash, as part of a leaked draft money laundering bill obtained by Coindesk," the publication noted on November 15, 2022.

Government policy decisions and proposed guidelines have prompted a number of cryptocurrency exchanges around the world to stop listing privacy currencies such as XMR and ZEC. The lack of listings gives privacy currencies much less liquidity, which makes them more susceptible to price fluctuations.