"Crypto winter" has come. And it looks more like an ice age.

Prices have collapsed, investors are leaving, and Sam Bankman-Fried is in jail. It's unclear if the industry can recover.

A year ago, the world of cryptocurrencies was booming, with prices for bitcoin and Ethereum at their all-time highs, celebrities stumbling with each other to promote expensive digital art, and logos from blockchain companies that grcing sports stadiums and Super Bowl ads.

That era is over.

Over the past year, cryptocurrency prices have fallen by more than half, the volume of transactions has fallen, and several high-profile companies have collapsed into liquidity crises. Last week's arrest in the Bahamas of Sam Bankman-Fried, the former CEO of what until very recently was one of the largest and most respected cryptocurrency exchanges in the world, has only deepened the feeling that the crypto bubble has emerged for good, taking with it billions of dollars in investments made by ordinary people. pension funds, venture capital and traditional companies.

Governments that have long cleared about regulation are suddenly pushing for more oversight, while federal regulators and law enforcement authorities have launched several civil and criminal investigations.

The cryptocurrency industry calls this time the "crypto winter." They say it's cyclical, just like a bear market for Wall Street — something that's happened before and will eventually blow over.

But experts say the ferocity and scale of this recession could lead to more of an ice age.

"Where we are is at a deeply existential point for the industry," said Yesha Yadav, a law professor at Vanderbilt University, who closely follows the regulation of cryptocurrencies.

A key deciding factor: "How deep is mold?"

The spectacular rise and fall of cryptocurrency markets has shaken the world of investors and incentives, which just a year ago were at the forefront of the market. Finance experts have compared the collapse to other major bubbles caught in the past — from the dot-com crash two decades ago to a run on Florida property a century ago.

Crypto has collapsed before, but this time it has fallen from a greater height – having gained mainstream acceptance in a way it hasn't had before, even finding itself in about 401(k) and retirement pension funds. It is not clear if he can recover.

Created a little over a decade ago and fuelled by the global financial collapse, cryptocurrencies are computer-managed digital assets intended to operate outside of established financial institutions, be it a bank or a government.

The most popular cryptocurrency, bitcoin, was created in early 2009 as a way to bypass the need for financial intermediaries, revolutionize the global economic system and make it easier for people to do business directly with each other. It went through several boom and bust cycles – especially in 2017 and 2018, when the price of bitcoin rose rapidly to about $20,000 before a series of high-profile scams and rumors about some countries planning to ban cryptocurrency trading led to the loss of 80% of its value in just a few months.

The hangover at that accident has persisted for some time, but the crypto world has begun to explode again amid the pandemic. The reduction in the interest rate has made it cheaper for people to borrow money and invest in speculative assets. Stock trading apps and new easy-to-use cryptocurrency exchanges have made the complicated process of buying and selling crypto currencies easy and accessible to millions of people who until recently hadn't heard of bitcoin. Non-fungible tokens or NTFs used crypto technology to allow people to trade digital art — which also took off.

By November 2021, a Pew poll said one in six Americans had invested in crypto. In the same month, the total value of cryptocurrencies tracked by data company CoinGecko exceeded $3 trillion, roughly equal to the UK's GDP.

Is crypto a house of cards, is it really a bubble?

A single bitcoin was worth nearly $68,000, nearly four times more than it was worth at the previous peak in 2017. The NFT market approached $25 billion in 2021.

And a "crypto bank" called Celsius Network offered double-digit interest rates to users who parked their digital currencies in their accounts.

"The whole model worked pretty well as long as the line continued to grow," said Molly White, a software engineer who became one of the crypto industry's most prominent skeptics by cataloging his scams, idiosyncrasies, and failures on his blog. "We see what happens when this hypothesis is no longer valid."

Shocking fall

One of the biggest winners of the crypto boom was Bankman-Fried, whose FTX cryptocurrency exchange made money by charging transaction fees every time someone used it to buy and sell crypto.

He earned millions of investments from well-respected venture capital firms such as Sequoia, and pension funds such as the Ontario Teachers Pension Plan, which valued the company at $32 billion.

With his curly brown hair mop, Bankman-Fried landed on the cover of Forbes and became one of the richest men in the world, his fortune being valued at $22.5 billion. The Bahamas resident told the magazine, as he had told others, that he was not making the money for himself. Instead, he said he would give it his all in the end — an altruistic mission that he said brought him into the crypto world.

he told the magazine. ( My main goal is to have a very big impact )

Bankman-Fried gave millions to politicians and was the second-largest political donor to Democrats in the midterm elections in 2022. He used his new influence to promote regulations that competitors said would give his own company an advantage.

The splashed advertisements featured celebrities such as NFL star Tom Brady, tennis champion Naomi Osaka and the main NBA player Stephen Curry, all of whom helped Hawk with the idea The FTX stock exchange was the promising, easy and reliable future of the industry.

"You in?" Brady asked his friends repeatedly in a TV commercial.

Many of them were. The company said it had more than 1 million active US users and also 5 million worldwide by the end of the previous year in 2021.

But earlier this year, the euphoria for cryptocurrencies is starting to fade. Rising interest rates, inflation, and fears about a possible recession caused investors to run from risk. Technology stocks, which have been steadily rising in value for a long time, have collapsed, much to the dismay of big investors in the financial industry and ordinary people who got into trading stocks and cryptocurrencies as well.

The first major blow came in May when a digital currency called TerraUSD — a widely owned "stablecoin" designed algorithmically to be tied to the dollar — collapsed. The surprise sale helped wipe out more than a quarter of the value of the crypto market.

The "crypto winter" was coming.

But Bankman-Fried and FTX so far seemed unharmed. The exchange made successful offers to save rivals, including Voyager - earning it praise. (Voyager withdrew from the deal when FTX filed for bankruptcy).

That changed in November when the cryptocurrency-focused coin desk news agency broadcast a story that reported that much of the value of Bankman-Fried's hedge fund, Alameda Research, was composed of a crypto token that FTX created on its own. The two companies were supposed to have clear divisions, and the story triggered a wave of control.

Canadian-Singaporean entrepreneur Changpeng Zhao, the owner of FTX's big rival, Binance, has announced that it will sell its stake of about $500 million in FTX's special token, causing a large sale and causing its value to fall.

The company froze withdrawals and began seeking emergency investments. Binance announced it would take over FTX, but canceled the transaction just a day later after Zhao said the company had "mismanaged customer funds."

FTX, Alameda, and dozens of other affiliated entities run by Bankman-Fried filed for bankruptcy. He resigned as CEO. Voyager is currently looking for a new buyer.

Douglas Campbell lost $27,000 on the U.S. ftx exchange and "tens of thousands" of dollars on fox's international stock exchange. The 42-year-old said he was attracted by Bankman-Fried's commitment to share its wealth and pedigree.

"So this was kind of just devastating," said Campbell, an economist living in Arlington, Va. "Now it's just kind of clear that most of the crypto is a scam."

Disappearance of assets

On Monday night, just one day before Bankman Fried testified before the House committee, he was arrested at his home in the Bahamas, where he lived and where FTX was located, at the request of the U.S. Department of Justice. Federal prosecutors are demanding his extradition.

Bankman-Fried was charged with eight counts, including fraud, conspiracy, and money laundering. Federal prosecutors argued that Bankman-Fried, among other crimes, used billions of dollars in client funds for personal investments and political contributions and used the money to repay billions of dollars in loans to Alameda. The Securities and Exchange Commission and the Commodity Futures Trading Commission have filed civil charges with similar indictments.

FTX owes its first 50 lenders $3 billion, according to the company, which is now run by a bankruptcy expert whose only job is to recover as much money as possible for investors and customers.

John J. Ray, the bankruptcy attorney who took over as FTX's CEO, testified Tuesday before the House Financial Services Committee, alleging that the company used QuickBooks, a personal accounting software, to keep records.

Ray said the allegations against Bankman-Fried were not sophisticated, but rather "simple embezzlement," and that many investors could not see all their money.

He concluded by saying: ( We will not be able to compensate all losses and pay all debts here ).

Bankman-Fried did not officially respond to the allegations, but in numerous media interviews, prior to his arrest, he portrayed himself as a bona fide founder who was above his head. He insisted that if the funds were mixed between Alameda Research and FTX, a key part of the government's allegations against him, he did not knowingly do so.

Mark Botnik, a spokesman for Pankman-Fred, declined to comment.

"If this happens in FTX, where else?" said Yadav, a professor at Vanderbilt. “This is where the question comes from!”

Other cryptocurrency players, such as BlockFi Bank and lender Genesis, have already rejected or are working to avoid bankruptcy. After Bankman-Fried's arrest, shattered investors withdrew about $3 billion from Binance, though Zhao downplayed the panic.

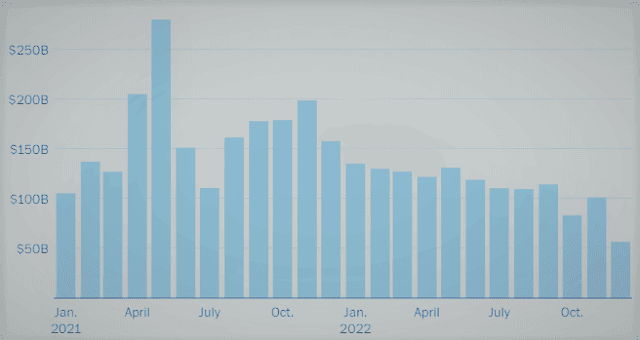

Cryptocurrencies are changing hands less often

The average daily trading volume at top exchanges is far lower than it was in 2021.

The total value of global cryptocurrencies tracked by data firm CoinMarketCap is now around $850 billion, up from $3 trillion a year ago. The average value of cryptocurrency transactions per day fell from $131 billion in May to $57 billion in December — a drop of more than half, according to CoinGecko.

Bitcoin's value has fallen 65% this year to around $17,500, although it has still been above its value for most of its existence.

Many cryptocurrency proponents remain optimistic - seeing the year-long slump as another jolting in the technology's allure for the future.

"In my opinion, crypto is just the next new technology and every new technology has its ups and downs," said Lou Kerner, CEO of Blockchain Co-investors Acquisition Corp. I, a cryptocurrency company.

The collapse of Ftx and other cryptocurrency failures over the past year have so far not endangered other financial markets, said Matthew Slaughter, dean of Paul Danos of the Tuck School of Business in Dartmouth. Cryptocurrency is a relatively emerging technology, he said, and it remains to be seen whether the world will have a use for the digital currency beyond speculation.

"We're talking about the reality that cryptocurrencies aren't very interconnected in the broader capital markets of the broader global economy," he said, adding that the lack of contagion wider can also be attributed to regulations aimed at ensuring that bankruptcies do not occur. total financial crises.

Darragh Grove-White, a digital marketer from British Columbia, has been investing in cryptocurrency since 2018. Since then, the 37-year-old said he has been "hurt" or cheated on multiple occasions.

He invested and lost money in Quadriga, a cryptocurrency exchange that Canadian authorities discovered in 2020 to resemble a Ponzi scheme. He also invested in Terra USD and Luna, as well as the Celsius Network, and lost money in both crashes this year – and froze several hundred dollars on FTX.

The total value of his cryptocurrency investment of around $400,000 dropped to around $40,000. However, he believes in the future of cryptocurrencies, citing an "optimism bias".

"It's a strength in that you don't get discouraged for too long," he said. "But that's a weakness in that sometimes you don't know when to leave."