India's central bank boss warns that crypto will cause the next financial crisis if allowed to grow

The governor of the Indian central bank said on Wednesday that he is not at war with cryptocurrencies, but warned that private cryptocurrencies would cause the next financial crisis if their use is not banned.

RBI Governor Shaktikanta Das said in a room full of banking executives and lawmakers that cryptocurrency has an inherently huge risk to the nation's macroeconomic stability. "After the evolution of last year, including recent events around the FTX exchange, I don't think we need to say anything else definitively. Time has proven that crypto deserves what it deserves today."

The switch in value of any product is called the market function. But unlike any other asset or product, our primary concern with cryptocurrency is that it has no official backing whatsoever. I think cryptocurrency or private cryptocurrency is a novel way of describing what is otherwise 100% speculative activity,” Das said.

In this way, the basis of cryptocurrency is the concept that it will destroy or disrupt the modern monetary system. I don't trust important banks or monetary systems included. I haven’t heard the proper arguments for its standard use,” he said, including that he believes cryptocurrencies should be banned.

Cryptocurrencies should be banned due to the fact that if they are allowed to grow so far, assuming they are highly regulated and allowed to grow, then as I say, the next monetary crash will come because of personal cryptocurrencies,” he said. India is one of the international locations that have taken a tough stance on cryptocurrency. before that,

Changpeng ( CZ Zhao ), founder and chief executive of the world's largest Binance cryptocurrency exchange, told TechCrunch in a recent interview that the firm does not see India as a very crypto-friendly environment. He said the firm is trying to convey its concerns to the local authority about local taxation, but said tax policies usually take a long time to change.

Binance is going to countries where regulations, laws, and legislation are pro-cryptocurrency and pro-business. We don't go to countries where we won't have a sustainable business – or any business, whether we're going or not," he said.

Coinbase which has backed both CoinDCX and CoinSwitch Kuber launched its crypto platform in the country earlier this year but quickly canceled the service amid a regulatory alert. Coinbase co-founder and managing director Brian Armstrong said in May that the company had disabled Coinbase's support for local infra UPI payments "due to some informal pressure from the [central bank] Reserve Bank of India." .

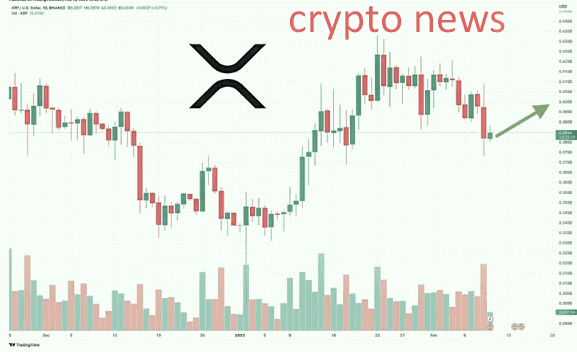

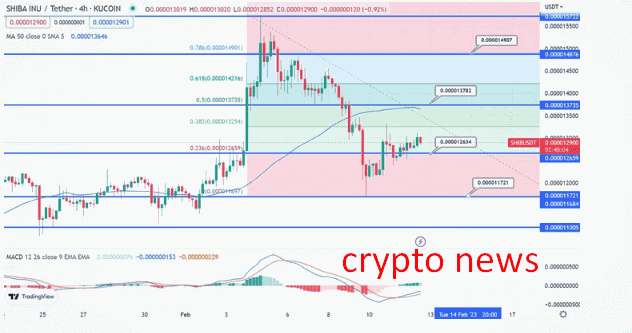

Crypto has closed out 2021 with a narrative that finances as we know them have been slow, faltering, and imprecise. Defi and DAOs have been the straight way forward. Cryptocurrency prices have been surging, and investors have been dealing with “HODLing.” Since May in Cryptocurrency has lost some of its luster in 2022 - two-thirds of its value has been lost.The failure of some facts caused the financial system to gradually collapse.

india's central bank