The worst days of bitcoin miners may have passed, but there are still some major hurdles.

Some improving indicators suggest that profit margins for bitcoin miners are slowly improving, but key areas of the industry remain under pressure.

Market analysis

Bitcoin's mining industry has been relatively stable compared to bear price action and the tumultuous fall of stock markets and lending companies.

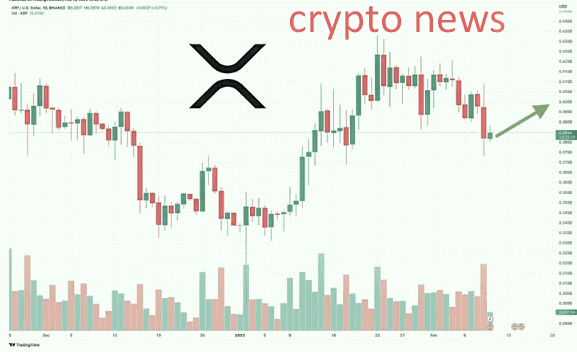

The network collapsed slightly towards the end of 2022, mainly due to an unprecedented blizzard in the US, and since then it has recovered strongly to surpass the previous peak of over 270 EH/s. It was particularly encouraging to see that the hash rate remained well above the lows in the summer of 2022, despite the consequences of the FTX crash.

However, despite the recent robustness in a variety of indicators, the mining industry faces many challenges, which will likely limit its growth in the future. Obstacles include low profitability, a threat from effective new-age machines, and the upcoming Bitcoin halving, which will cut rewards in half.

BTC mining is still a stressful industry

While the hash rate of the Bitcoin network has improved, miners are still under a lot of stress due to low profitability. Bitcoin miners' earnings have fallen to a third of their value at the top. Before the May 2022 price crash, miners were making more than $0.22 a day on TH/s, a figure that has now dropped to $0.07.

The percentage share of small miners with breakeven prices of more than $25,000 has fallen from 80% in 2019 to 2% by 2022, which is a positive sign of an end to the miners' surrender.

The sustainability of medium-sized miners with profitability prices between $20,000 and $25,000 depends on the efficiency of participants' capital. The struggle for them is to survive until the bullish trend begins, hoping to benefit from the next bullish cycle.

The significant drop in prices for medium-sized equipment indicates a slowdown in demand for it. According to CoinShares, the reduction in the price of equipment will allow capital-rich entities to “reduce the cost of capital expenditures on TH/s and increase production without incurring additional cash-in-progress costs” by buying hardware cheaply. Even so, this will be at the expense of existing miners, which will likely curtail the growth of the industry as a whole.

The independent research firm, The Bitcoin Mining Block Post, has come to a similar conclusion about the growth of the industry in 2023. Their analysts predict that the cost of miners "will move sideways and have a gradual upward trend", as it did in 2020.

Compression of more capable ASICs and the next half of BTC

The current Bitcoin mining industry is also facing major challenges from getting new and efficient machines and reduced rewards after the halving in 2024.

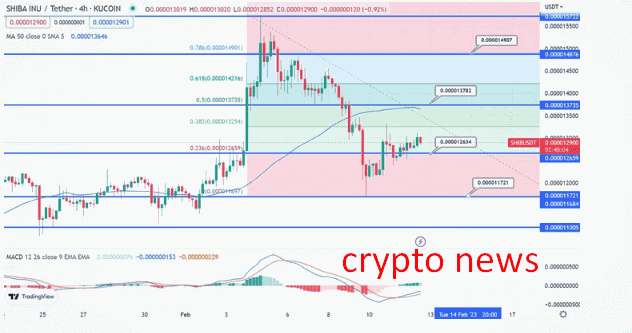

In July 2021, more energy-saving miners have arrived, offering over 100TH/sec per Joule. This trend accelerated until Q2 2022, with the launch of new hardware equipment that had more than twice the efficiency of existing miners at the time. The breakeven prices of some of these miners are under $15,000

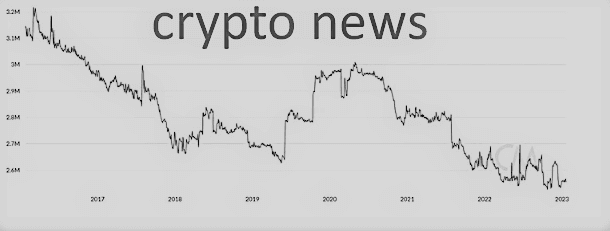

The one-hop supply value of Bitcoin miners is calculated from the total holdings of addresses that received tokens from the mining pools. The indicator has seen a slight increase in the miners' balance since the beginning of 2023. However, the total amount is still below the lows of 2019, indicating the challenges of a rapid recovery in conditions, unless the price favors miners.

|

| Supply of a single-hop Bitcoin miner. Source of Quinmetrix |

The fact that miners continue selling with little hope of recovery in the short term could destroy the hopes of those anticipating a decent rally in 2023. The good news, though, is that the worst days of giving up may be over. While slow and steady, miners can continue to grow and start accumulating again and help in the next bullish rally phase.

.png)

.png)

.png)