Why the resistance to bitcoin breaking at $23K and $25K could be dramatically bullish

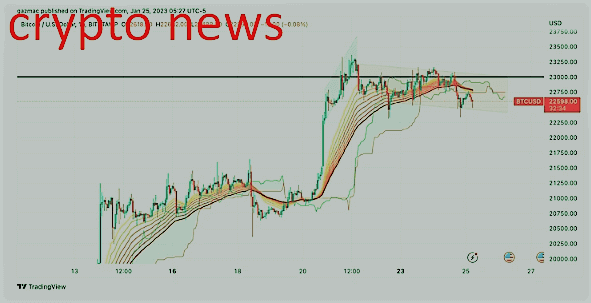

The price of bitcoin is consolidating below the significant level of $23,000 and is still up nearly 50% from its November 21 lows, despite being back 1.5% in the last 24 hours to $22,600.

If the largest cryptocurrency after market capitalization can successfully challenge the resistance between $23k and $25k, it will be essential to supporting its upward rebirth – it could also signal the end of the bear market.

If and when bitcoin passes through the $23,000-25,000 resistance region, there is undoubtedly an open road ahead of $30,000.

But it is worth living on the fact that $ 23k is such a strong area of resistance.

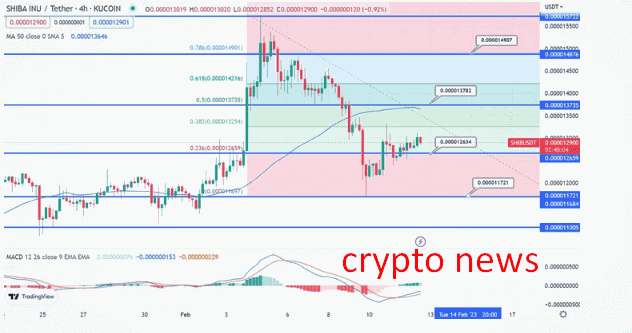

We can identify three challenges perceptible at the $23k level that failed to hold between July and August last year (see chart annotations below).

Expectations of a quick and successful assault on this important price level have proven to be too far a bridge for bulls, for now.

Bitcoin price collects fuel to ignite bullish fires

However, the longer Bitcoin oscillates around its current price levels, giving sellers a period to dislodge their savings, the greater the confidence in the bullish future. Bitcoin gathers fuel to light the fires again.

When you zoom in on the 1-hour chart, note the contrast in the slope angles and steepness of the current green channel and red bearish channel.

Instead, the current minor correction has left room for sellers, who can benefit in the short term, paving the way for the next higher phase.

The Exponential Moving Average (EMA) ribbon and the Ichimoku cloud on the 4-hour chart show that bitcoin is trying to build support at the current price point, but there could be a fragility emerging here.

To read the EMA ribbon, readers should be aware that it stretches from MA20 (yellow) to MA55 (brown).

Crucially, perhaps, the 1-hour candles and the chart show that the price has fallen below the EMA bar and dropped to the Ichimoku cloud, which is showing the low of the current session.

An abundance of caution would suggest that it is sensible to consider, even for bulls, the possibility of a retry at $21k before a new attempt to exceed $23k

How Bitcoin Price Will Be Affected by US Data on Inflation, GDP, and Consumer Sentiment

However, beyond technical analysis, we can look at macro news to have an impact on price this week – and this is something of a recurring theme of the last few weeks and months.

However, there is a binary consideration to consider that ultimately is based on judgments on inflation and recession prospects that can be defined from U.S. economic data.

Tomorrow, Thursday the 26th, US GDP growth and durable goods orders could provide direction on whether the US economy will have a soft or hard landing.

On Friday, the fed's preferred inflation measure – the personal consumer spending price index (PCE) – is launched, followed by a reading closely watched by Michigan Consumer Sentiment.

THE PCE data will be analyzed by market participants in crypto and elsewhere to see if it confirms what was evident in last week's retail sales data, namely that consumers postpone the decision on large expenses and reduce expenses everywhere.

Meanwhile, the first, THE PCE data, will be evaluated to see if it confirms the previous indication in the CPI data that inflation in the US has surpassed its peak.

What are the implications for Bitcoin from the looming recession in the US?

All of the above data has an influence on whether the Fed will slow interest rate hikes.

Any signs that the economy is getting cold will be music to the ears of those who own risk assets such as crypto. But there is another side to this, which could be bad news throughout if the data signals an increased likelihood of a deep recession.

If powerful companies like Amazon and Microsoft lay off thousands of workers, it doesn't bode well for the rest of the economy. It could be argued that tech companies have made the mistake of over-accepting jobs during the pandemic, so it can be justified as a special case, but that seems a bit insignificant.

Data on whether the U.S. is heading into recession sooner rather than later remains mixed.

On the one hand, home production and sales contracts decline, but on the other hand, employment in factories and construction works remains strong, although this general discrepancy can be explained by some lag effects.

However, a weakening – but not too weak – economy is likely to reinvigorate bulls in the cryptocurrency market.

A weakening economy implies that the Fed will be more likely to move away from aggressive interest rate hikes. In fact, it could provide the boost to take bitcoin through the $23k barrier and above the critical $25k level previously identified.

The price of Bitcoin may be initially separate from stocks

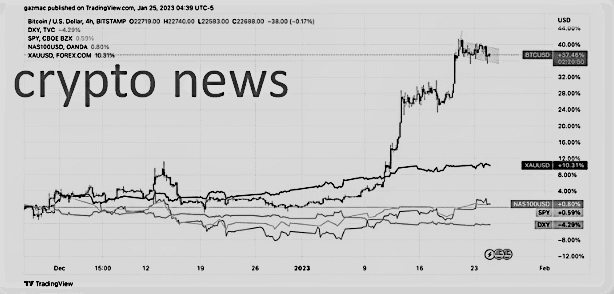

Another important part of the picture is the tentative and partial decoupling of the bitcoin correlation from the S&P 500. Bitcoin has rallied, to some extent, by itself, as you can see in the chart below.

Note, we will use the SPDR S&P 500 ETF (SPY) as a proxy for the S&P 500 as it is both the cheapest and most liquid way to get exposure to the index.

Compare it also with gold (XAUUSD), the dollar index (DXY), which measures the value of the dollar against a basket of the most traded currencies.

If bitcoin is a main indicator, then a growing S&P 500 and Nasdaq could move significantly higher.

Such an outcome would be mill-to-mill for a strong bullish configuration under development in 2023, providing medium-term encouragement for future price support actions for bitcoin and the rest of the crypto complex.

And then there is the bitcoin halving event that comes to bring joy to the bulls

Finally, in terms of the longer-term forecast and how this could have an impact on current institution and retail accumulation strategies, we should consider the next bitcoin halving event that occurs in March 2024.

That's a little more than a year away and is a fundamental that hasn't failed as a positive catalyst for BTC.

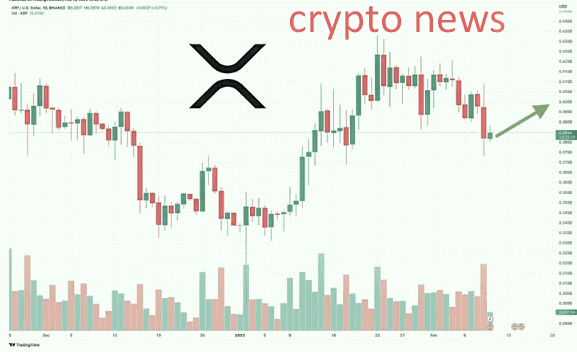

Before you buy bitcoin, consider some other options for your crypto wallet

But if bitcoin's current entry point is not to your liking, then it might be worth looking at some crypto projects with high potential for lower capital.