How long would you need to keep your cryptocurrency before selling it?

|

| crypto news |

The cryptocurrency market is volatile and unpredictable. It's hard to keep track of all the coins, let alone decide which one is worth your money. Focusing on long-term survival, rather than the few gains made in a short period, is essential when investing in cryptocurrencies.

Is my investment aligned with the cryptocurrency community?

The cryptocurrency community is an important part of the investment world that can be difficult to value.

What things should you know about this?:

The volume of activity on these communities' social media channels?

How much community support do you get?

How many people actively promote it?

Do they do it out of passion or do they have material goals and ambitions?

Is there an active team of developers contributing updates?

What will they do in the near "future"?

A good project will excite you, while a bad project will leave you cold. Even if you look at the price charts and see that everything looks good now does not mean that it will not collapse later.

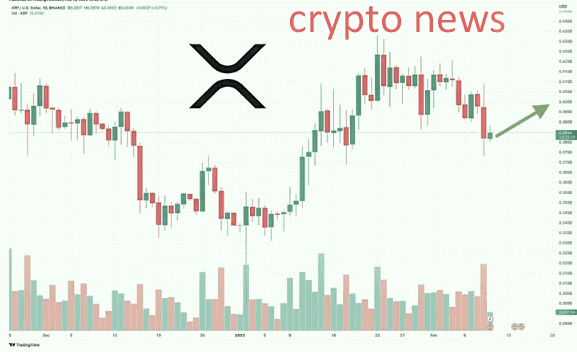

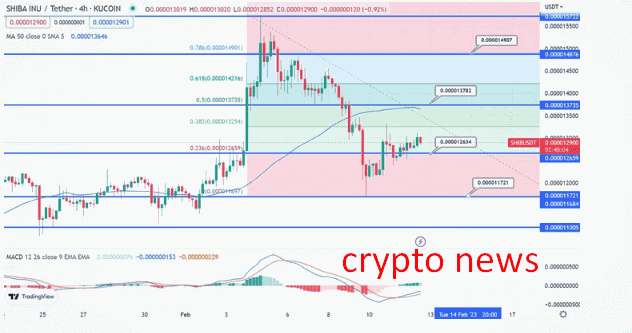

What is the current trend of the currency? Is it going up or down?

Check the price of the currency on different exchanges. The price of some cryptocurrencies can vary greatly depending on where to buy them, so be sure to compare apples to apples by checking the exchange for more prices.

Look at the price chart. Price charts are very useful because they show how volatile a currency is over time. This gives you an idea of whether its value is rising or falling. These charts can be found by searching for one on "Google" or using "TradingView".

Compare with other currency prices and movements to get an idea of what's happening in the general trends.

Has the currency peaked or is there more room for growth?

It would be best if you also considered the current price of the currency and how it is likely to change. If your investment is still at an early stage, it would be best to wait until you have more information about what will happen to its value in the future.

For example, if you believe that Bitcoin will continue to increase in value for years to come, then you should keep your currencies for as long as possible. You may even want to sell later, when a Bitcoin is worth $80k or more. Opt for this only if you do not expect negative news about cryptocurrencies over time. This is unlikely to happen, however

Is there enough liquidity on the stock exchange for my coins?

The first thing you need to know about liquidity is that it is not only about the amount of money in an exchange, but also about how quickly and easily This money can be passed on from one person to another. The more liquid any cryptocurrency is on the exchange, the easier it will be for you to sell it without having to accept an extremely low price.

Liquidity also plays a role in determining the amount you can buy or sell at any time. For example, let's say there is no one else trying to buy or sell the coins at the same time as you. In this case, they will still be available regardless of the price at which they are listed. Nothing will stop anyone from buying them at all until someone else comes along who desperately wants them

On the other hand, if many people decide to buy or sell cryptocurrencies at prices higher than yours, there will be less competition among you for those cryptocurrencies.

How big is the currency compared to other currencies?

It will help if you also take into account the size of the coin compared to others.

A low volume doesn't necessarily mean you shouldn't buy, but it does mean that your investment will be more volatile than if you had invested in a larger volume currency. The larger the volume, the less likely it is that a retail investor will be able to significantly influence the price.

Are you planning to sell your cryptocurrency in six months or so? A currency with a lower trading volume may be better. Price movements are unlikely to affect the value as much as in the case of a high-volume cryptocurrency.

Plan well when you decide to sell your cryptocurrency

When you plan to sell your cryptocurrency, it is essential to have a long-term vision of the market. You want to avoid getting caught up in short-term volatility and make a hasty decision that could cause long-term financial damage.

It is also important to note that many other factors could affect the price of your investment when selling. This includes market sentiment and external news events.

It's pretty hard to figure out how much money you'll have after taxes after you've sold your crypto assets. There is no need for additional headaches to not be aware of these variables ahead of time

Conclusion

You'll probably lose money if your investment isn't aligned with the cryptocurrency's roadmap, community, or current trend.

You need to determine why you bought the currency in the first place and if it still makes sense to you. If there is not enough liquidity on an exchange for your currencies, then it will be difficult to sell them quickly.

Finally, how much volume does this currency have compared to others? If it has less than other currencies available on the exchanges at the moment, it can be almost impossible for you to sell quickly as well

None of the information on this website is an investment or financial advice and does not necessarily reflect the opinions of Crypto Revolution or the author. Crypto Revolution is not liable for any financial losses incurred by acting on the basis of the information provided on this website by its authors or customers. Always conduct your research before making financial commitments, especially with third-party, presale reviews, and other opportunities.