These 4 altcoins can attract buyers with Bitcoin stagnation

Bitcoin remains stuck in a tight range, but LTC, APE, ICP and BIT are showing signs of starting a new upward movement.

|

| crypto news |

Price Analysis

Bitcoin (BTC) volatility remained low in the last few days of last year, indicating that investors were not in a hurry to enter the markets.

Bitcoin ended 2022 close to $16,500, and the first day of the new year failed to ignite the markets. This suggests that traders remain cautious and look for a catalyst to start the next trending move.

Several analysts remain dissatisfied with bitcoin's short-term price action. David Marcus, CEO, and founder of Bitcoin Lightspark said in a blog post published on December 30 that he does not see the cryptocurrency winter ending in 2023 or even in 2024. He expects it will take time to rebuild consumer confidence, but believes the current reset could be good for legitimate firms in the long run.

Calls to the bear are an indication that the feeling remains negative, but there is also a silver lining. Usually, bear markets end after the last bull has become a bear. With no sellers left, the price action stabilizes and new buyers enter the market. This usually causes a reversal and begins a new movement upwards.

While Bitcoin remains tied to the range, certain altcoins show signs of strength. Let's check the charts and find out what important levels to watch out for.

BTC/USDT

The failure of the bulls to push Bitcoin above the 20-day EMA ($16,778) has boosted bears trying to sink the price without immediate support at $16,256.

The 20-day EMA is gradually tilted down, and the relative strength index (RSI) is close to 43, indicating a minor advantage for sellers. If the bears sink the price below $16,256, the BTC/USDT pair could drop to $16,000 and subsequently to life support to $15,476. A pause under this support could signal the resumption of the downward trend.

This negative opinion will be invalidated in the short term if buyers push the price above $17,100. Such a move will indicate aggressive buying on goals. The pair could then gain momentum and make a dash to $18,388. Sellers are once again expected to mount a strong defense at this level.

-

The pair have been locked between $16,256 and $17,061 for some time. The bounce on the support faces selling near moving averages. This suggests that bears continue to sell at rallies.

However, a minor positive is that the bulls have not given up much ground, and the pair remains close to 20-EMA. This increases the likelihood of a break above moving averages. If this happens, the pair could reach $16,800 and then $17,061.

On the downside, bears will have to pull the price under immediate support of $16,429 to set up a $16,256 retest.

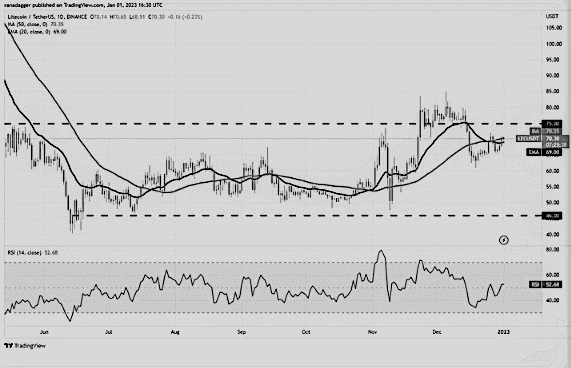

LTC/USDT

Several major cryptocurrencies are still looking for a bottom, but Litecoin (LTC) is well above its June low. This indicates strong demand at lower levels.

The 20-day moving average ($ 69) and the RSI are slightly above the midpoint, indicating a balance between supply and demand.

The advantage will be in favor of buyers if they push and support the price above the moving averages. The LTC/USDT pair could then climb to the resistance at $75. This is an important level to watch in the short term as a breakout to the upside could open the doors to a rally to $85.

On the contrary, if the price drops from the current level and breaks below the 20-day moving average, the pair may fall to $ 65.

The moving averages on the 4-hour chart are moving slowly, and the RSI is in positive territory, signaling that the bulls have their upper hand. There is minor resistance at $72, but if that level is passed, the up-move could reach $75.

Sellers are likely to mount a strong defense in the area of $72 to $75, but if the bull bulls bullded their way through, the rally could accelerate and reach $80. On the downside, a break below $65 could open the doors for a decline to $61.

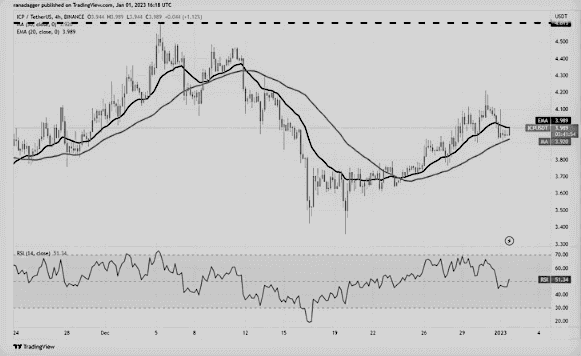

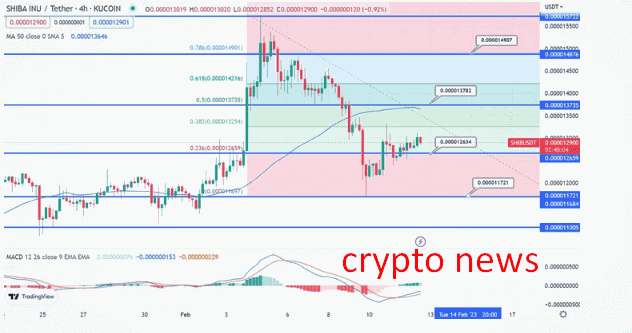

APE/USDT

ApeCoin (EPA) has been trading inside a large range between $3 and $7.80 for the past few months. Moving averages have flattened and rsi is close to the midpoint, indicating that selling pressure could be reduced.

The bears did not allow the price to rise above the moving averages, but an encouraging sign is that the bulls maintained the buying pressure and did not let the price slip. This increases the possibility of a break above moving averages. If this happens, the APE/USDT pair could climb to $4.58 and then $5.25.

Alternatively, if the bears do not allow the price to pierce the resistance above the head, the pair could drop again to the vital support at $3. A slide below $3 to the $2.61 support area could indicate the start of the next stage down.

This cryptocurrency pair has formed a symmetrical triangle on the H4 chart. This indicates indecision between bulls and bears. Although the moving averages are flat, the RSI has risen into the positive zone, indicating that the bulls have a slight advantage. If the buyers can breach the small barrier at $3.71, the price may reach the resistance line of the triangle.

Instead, if the price turns down and crosses below the ascending line, it will suggest that the bears are back in play. The pair could then be seen at $3.20 and later at the important support at $3.

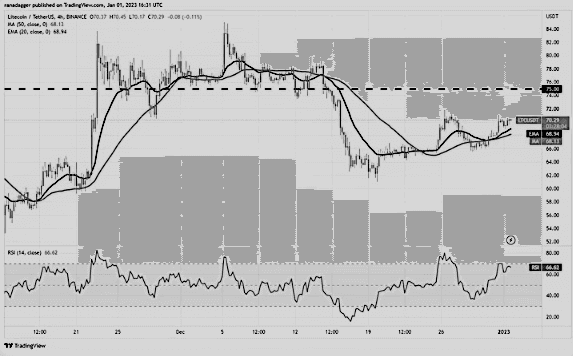

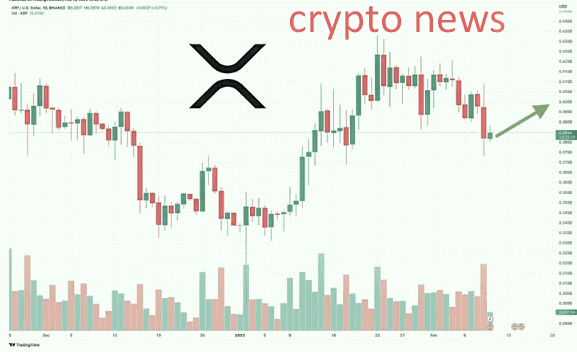

ICP/USDT

Internet Computer (ICP) continues to trade below the breakdown level of $4.61, but RSI forms a positive divergence, indicating that the selling pressure could be reducing.

Buyers pushed the price above the downtrend line on December 30, but the bulls could not maintain the breakout. The bulls again tried to beat the barrier on January 1, but the long wick on the candle shows that the bears are selling at intraday highs.

If the price falls and falls below the 20-day exponential moving average ($ 3.91), the bears will try to plot the price at $ 3.60 and then at $ 3.40.

Conversely, if the price reverses from the moving average, the bulls will try again to lead the price above $ 4.21. If they manage to get it out, the ICP/USDT pair could rise to $4.61, as the bears may try to prevent the recovery.

Sellers managed to hold the 50-SMA but failed to hold the price above the 20-EMA. This indicates that sellers are appearing on higher levels. If the price turns down and drops below $3.90, the pair could drop to $3.76 and then $3.60.

Alternatively, if the bulls break through the overhead resistance zone from $4.10 to $4.21, the boost could pick up and the pair could rise to $4.46. This level may become a minor hurdle, but it may have the potential to be crossed. The pair could then reach $4.61.

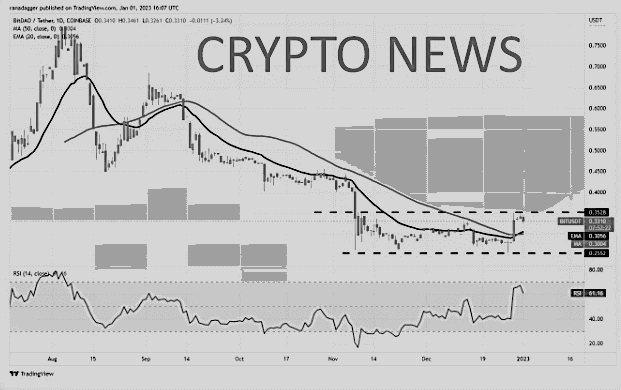

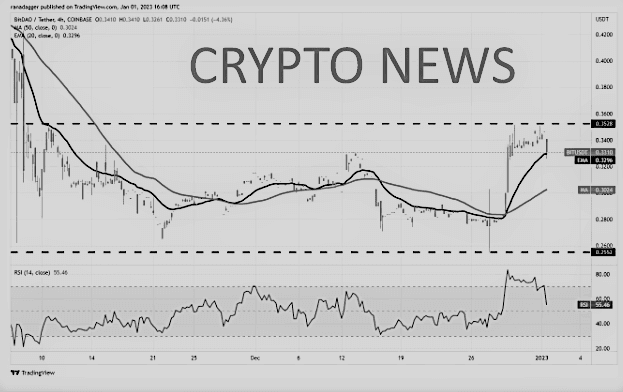

BIT/USDT

BitDAO (BIT) has consolidated between the $0.25 level and the $0.35 level over the past few days, but the price action is showing signs of a possible breakout.

The moving averages have completed an upward crossover, warning of a possible trend change. If buyers catapult the price above $0.35, the BIT/USDT pair could start a new upward trend. The pair could then try a rally at a target of $0.45.

On the other hand, if the price drops from $ 0.35, it will suggest that bears guard this level with vigor. The price could then drop to the 20-day EMA ($0.30).

If the price returns from this level, it will suggest that the sentiment could have gone from selling on rallies to buying on goals. That could boost the prospects of a break above $0.35.

Sellers will have to grab the price below the moving averages to invalidate the bullish view. The pair could then get stuck inside the range for a longer period.

The price fell strongly from the high resistance to $ 0.35, but the bulls are trying to stop the pullback at the 20-EMA. If the price on the 20-EMA returns strongly, it will indicate a strong buy on the targets. The pair could then expand the high resistance range and start crawling upwards at $0.40 and then $0.42.

Conversely, if the price falls and falls below the 20-EMA, more short-term bulls can book profits. The price could pull at 50-SMA. Such a move will indicate that the pair may spend a little more time within the range.